International activity in U.S. residential real estate is having a good year, and it shows no signs of stopping. According to a recent profile assembled by the National Association of Realtors (NAR), the 12-month period of April 2015-March 2016 saw an overall increase of foreign buyers’ interest in U.S. residential property, as well as an increase in U.S. domestic clients’ interest in residential property abroad, creating a positive effect in the U.S. real estate market with optimistic predictions for the next 12-month period.

What exactly does this mean, and why is it important? Manhattan-based real estate agency Platinum Properties has compiled a quick rundown of facts and figures so you can know exactly what’s going on.

Who exactly is buying up property in the U.S.?

First, you have to understand that there are two types of international, or foreign, clients:

- Type A: non-resident foreigners who purchase property in the U.S. as an investment, for vacations, or for other visits of less than 6 months

- Type B: resident foreigners, usually recent immigrants or temporary visa holders, residing for more than 6 months in the U.S. for professional, educational, or other reasons

This 12-month period saw a 3% increase in the number of residential property purchases by foreign clients, but a decrease in dollar volume from $103.9 billion in the previous period to $102.6 billion.

Why? The recent slowdown in economic growth of many countries compared to the U.S. and the subsequent strengthening of the U.S. dollar, caused by political and economic activities such as the controversial “Brexit” vote, has helped to position the U.S. as an appealing residential opportunity.

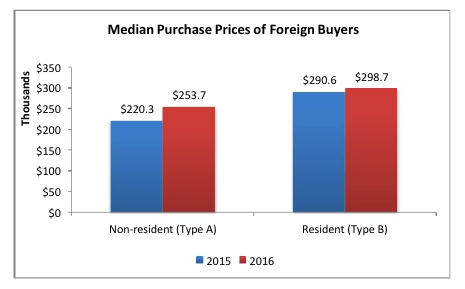

The decrease in dollar volume compared to the increase in number of properties purchased can be explained by the type of buyer conducting these transactions. There were more Type B buyers (59%) in this period than Type A buyers (41%), and Type A buyers tend to purchase the more expensive properties.

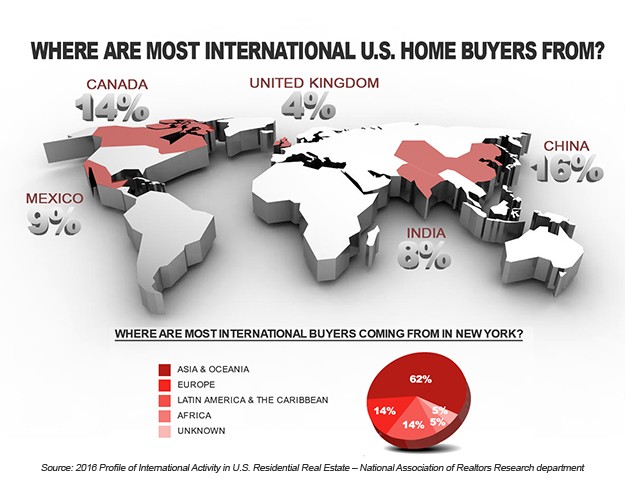

According to the NAR’s profile, 45% of foreign buyers came from China, Canada, India, the United Kingdom, and Mexico. China ($27.0B), India ($6.1B), and Mexico ($4.8B) made up the majority of Type B buyers, while Canada ($8.9B) and the United Kingdom ($5.5B) made up the majority of Type A buyers.

Where are these foreign buyers setting their sights?

While international clients have been buying up properties nationwide, 51% of the purchases are occurring in five states, typically known as destination spots for their big cities and tourist attractions:

- Florida (22%)

- California (15%)

- Texas (10%)

- New York (4%)

- Arizona (4%)

Certain factors contribute to a buyer’s decision on where to purchase a property, such as proximity to the home country; the presence of relatives, friends, and associates; job and educational opportunities; and climate and location.

Are they only buying?

The U.S. as an ideal location for foreign investment and residential property isn’t just a recent development, which means there are international clients who are looking to sell, too.

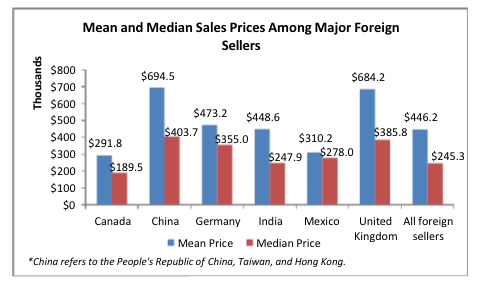

The majority of clients who sold their U.S. residential property in this 12-month period originated from Canada, China, the United Kingdom, Mexico, Germany, and India, with an average sale price of $446,191 and a median (middle value) of $245,331. The sale of U.S. residential property is partly due to the strengthening of the U.S. dollar.

What about domestic buyers?

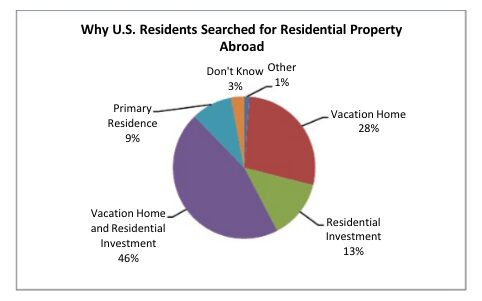

Just as foreign buyers are looking increasingly into the U.S. market, U.S. domestic buyers are looking more into purchasing property abroad. 14% of NAR respondents had domestic clients who were interested in foreign property, a significant increase from 6% in the previous 12-month period, with the markets in Mexico, Costa Rica, the Philippines, Colombia, and Canada garnering the most attention. Of the 14%, 79% were seeking a residential property, most wanting to use it as a vacation home and/or residential rental property. This validates the comparative strength of the U.S. dollar and economy in the international market.

To learn more about the impact of international buyers on the U.S. market, and specifically New York City, get in contact with us today!